This week volatility came back after nearly a month of very calm markets. The VIX (the volatility index) jumped from 15 to nearly 21. Most of this was driven by two key factors. First, the Federal Reserve met this week and released a statement that spooked investors. Second, today is a quadruple witching day in the options markets. Quadruple witching refers to a date on which stock index futures, stock index options, stock options, and single stock futures expire simultaneously. While stock options contracts and index options expire on the third Friday of every month, all four asset classes expire simultaneously on the third Friday of March, June, September, and December. We think that the markets overreacted to both events.

The Federal Reserve kept the Fed Funds Rate close to zero in its Wednesday announcement, but changed the dot-plot of future rate changes. The members of the committee projected that the Fed might raise rates twice (instead of zero times) near the end of 2023. This was a bit of a surprise to the financial markets. However, Chairman Powell said in his statement, “The dots are not a great forecaster of future rate moves…it’s because it’s so highly uncertain. There is no great forecaster—dots to be taken with a big grain of salt [sic].” So basically, the Fed said that they are thinking it might be necessary to raise rates two years from now if everything goes great. Seems pretty flimsy to us, but the markets reacted. The cyclical sectors of the market sold off after this announcement and longer-term interest rates fell. The interest rate curve flattened as investors rushed to longer-term bonds. The 20 year+ US Treasury bond complex was up over 3% after the news.

Today due to the huge moves in gamma exposure from quadruple witching, stocks and bonds are all over the place. Gamma is the second derivative sensitivity of derivatives to their underlying securities. Well how does this affect financial markets? As investors buy call options or futures on various financial securities their counterparties become short that underlying security. They must then enter the markets and buy the securities to hedge their options/futures books. The hedge isn’t perfect as the gamma of the portfolio changes based on the changes in price of those securities. This forces constant trading to make sure the banks don’t blow up their options books. When an expiration date occurs, the banks may be over-hedged and will need to sell down their hedges thus selling many of the securities that they purchased over the previous few months.

Combining both events this week has spiked volatility and sent financial securities ripping higher/lower based on the outstanding gamma exposure. The punchline is we think that it will calm down and that this volatility has made several markets more attractive based on their fundamentals.

One such sector is energy stocks. While we already have exposure to this sector, the big downdraft this week has made it even more attractive. As of right now, the S&P Energy Sector is down 4.5% this week which we think is a bit of an overreaction. Fundaments still look good and we’d like to address those this week.

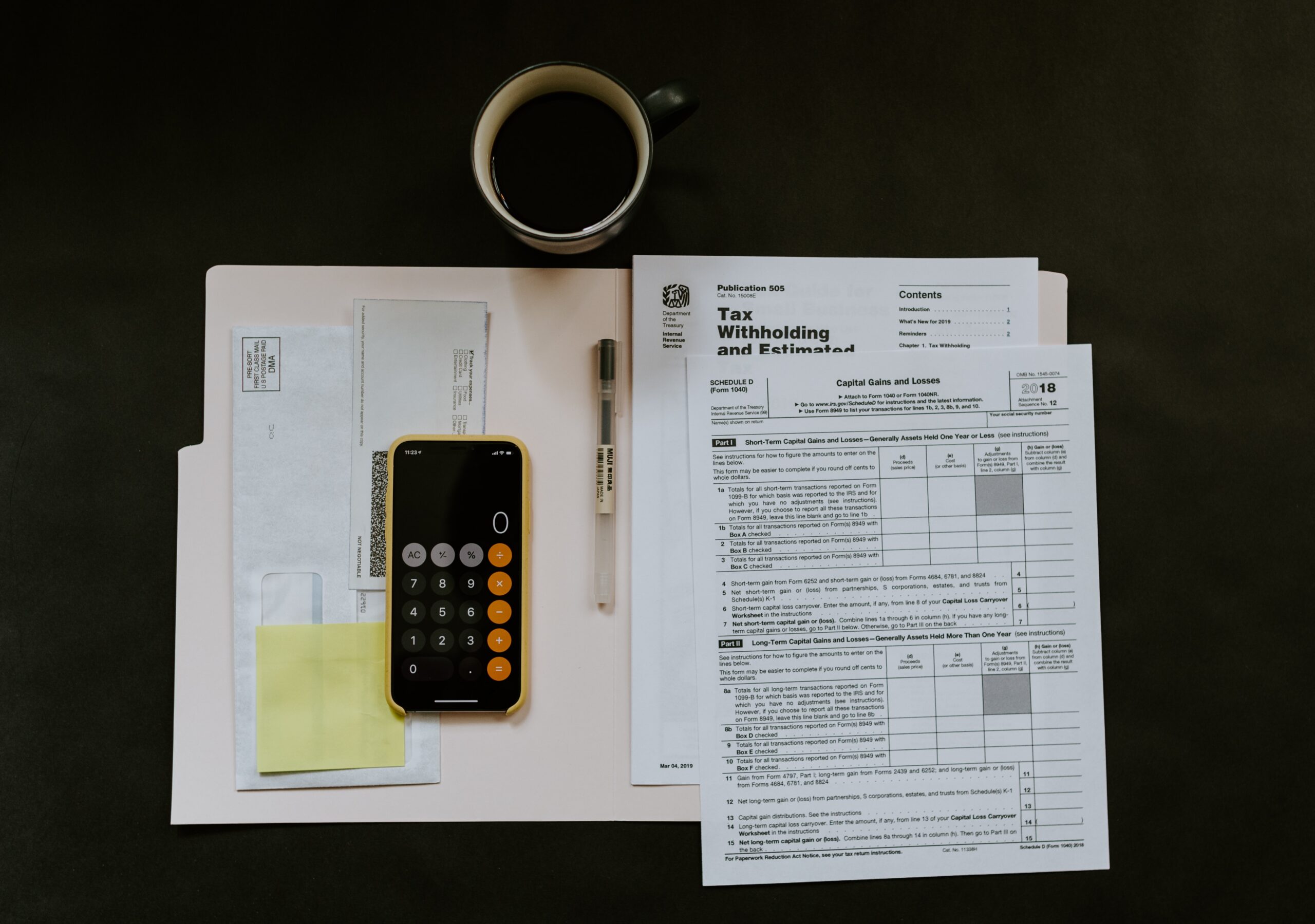

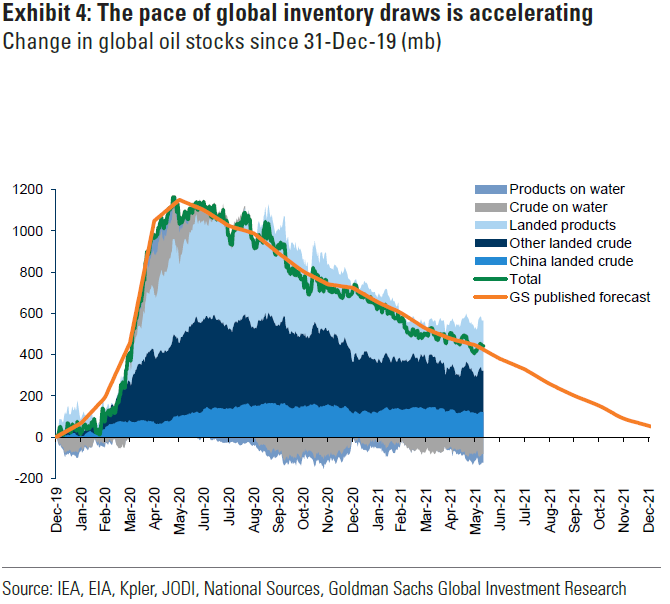

The crux of the energy trade is oil prices. As we’ve laid out in several notes, we think that long-term fair value for oil is $60 per barrel. Today, Brent Oil price is trading at $73 per barrel. So why are we still bullish on this sector? It comes down to two key fundamental points — oil supply pressures and valuation. Oil prices follow a classic economic supply & demand framework. Presently, oil demand is rising more quickly than supply and we see this mismatch lasting through the summer. In the last month, global oil demand increased by 1.5 mb/d (million barrels per day) to 96.5 mb/d. Consensus is for this to increase to 99 mb/d by August. The increase in demand is driven by a return of economic activity post COVID. Shipping, travel and commuting are all set to rise over the next few months.

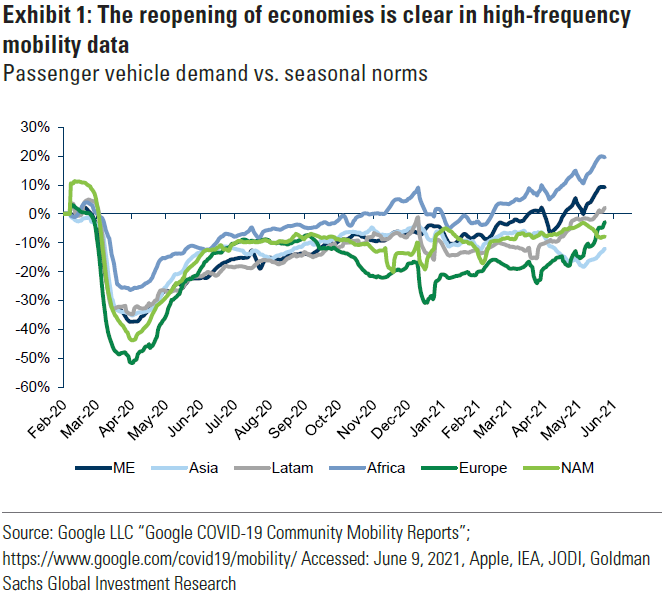

However, supply doesn’t seem to be keeping up with this increase in demand. As demand increases and supply is constrained, the global inventory draw accelerates. This will push oil prices higher. Goldman Sachs estimates that by August Brent Oil could reach $80 per barrel.

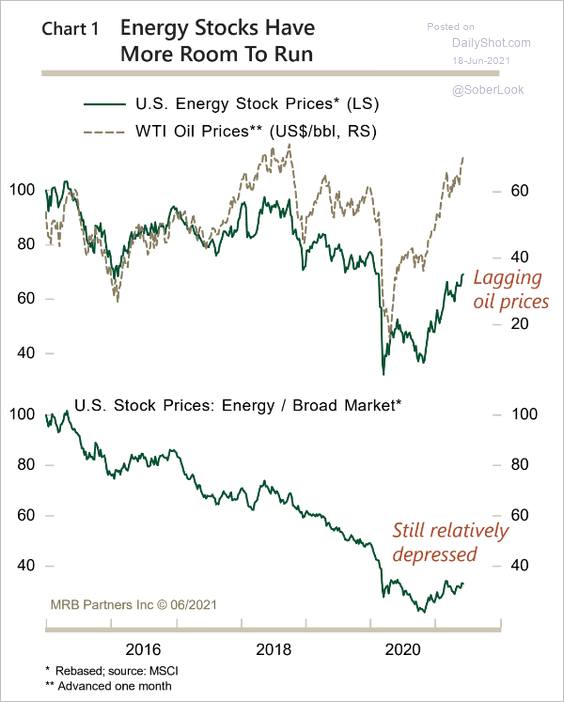

Assuming that oil prices do reach these levels, the energy sector stocks should follow suit. So far this year, the stock prices have actually lagged oil price increases. We would expect that to continue based on fears of increased supply if Iran sanctions are cancelled. But the sector should still be able to climb higher over the next few quarters.

Valuations still look attractive in the sector. XLE is trading at a 16% discount to historical valuations based on forward EPS (earnings per share) vs. the S&P 500 trading at a 34% premium. Hedge fund manager David Tepper commented this week that he thinks that energy stocks are the cheapest stocks by every measure due to the ESG (Environmental, Social, and Governance) movements shift away from the space. We agree. We still see energy stocks as a solid risk-adjusted return investment in the current environment so long as the exposure is sized correctly.