In our February 19th note we discussed the current unfavorable risk/reward in High Yield Bonds. This week, however, we are going to talk about the private credit markets.

First, it’s important to understand some of the basics of a corporate capital structure so that you can see how these different types of debt fit into the capital markets. A company’s capital structure is basically how the company is capitalized (or where has the money come from). While we could simply think of a company’s capital structure in terms of debt and owner’s equity, it is much more nuanced than that. This is a basic layout of a capital structure by priority:

- Secured Debt

- Revolving debt (A line of credit a company establishes with a bank which it can access as it needs funds)

- 1st Lien debt

- 2nd Lien debt

- Senior Unsecured Debt

- Subordinated Unsecured Debt

- Preferred Equity Shares

- Common Equity Shares

Priority defines the ranking of repayment in case of bankruptcy. So a secured revolver has first priority and so on down the line until we get to common stock. Not all of these types of securities exist at every company. For the purposes of this analysis we are focused on the debt securities.

High Yield Bonds usually fall in the category of Senior Unsecured and Subordinate Unsecured Debt. The sister market to High Yield Bonds is the Leveraged Loan market. This loan market is focused on 1st and 2nd Lien Secured Debt and is widely traded just like High Yield Bonds. Obviously the Leveraged Loan market is higher in priority or said another way—higher up the capital structure. Because both of these debt markets are readily accessible to investors, borrowers tend to have an advantage versus lenders. This competition among lenders has led to low interest rates, weak lender covenants, and higher volatility of returns.

Like we mentioned in our February 19th note, High Yield Bonds actually aren’t providing much yield at all these days. Presently the yield from HYG (the largest High Yield Bond ETF) is just 3.72%. Historically the average annual default rate for High Yield Bonds is 4% leading to an annualized loss rate of about 1.8%. So at 3.72% the default adjusted yield for HYG would be just 1.9%. The Leveraged Loan market its not much better. The current yield from BKLN (the largest Leveraged Loan ETF) is just 2.4%. The historical average annualized loss rate for Leveraged Loans is about 1.1%. Lower than High Yield Bonds due to their higher priority and thus larger recovery rate. So Leveraged Loans at 2.4% would lead to a meager 1.3% default adjusted yield. It’s reasonable to get 1.3-1.9% from a US Treasury Bond, but not from corporate debt.

In addition to the very modest yields offered in these public debt markets, the lender protections, or covenants, have been severely weakened. Covenants are part of the debt contract and limit certain activities of the borrower. The most common of these covenants are:

- Restricted Payments

- Keeps the cashflows of the borrower inside the company so long as the debt is owed. It limits dividend payments to equity holders, stock repurchases, repayment of lower priority debts, etc…

- Limitations on Indebtedness

- Limits the total amount of debt the borrower can incur and the amount of debt at a similar or higher priority of the loan

- Limitations on Liens

- Limits the ability of a borrower to pledge collateral to other debts

- Limitations on Asset Sales

- Limits the borrower from disposing of or transferring assets away from the entity that owes the debt

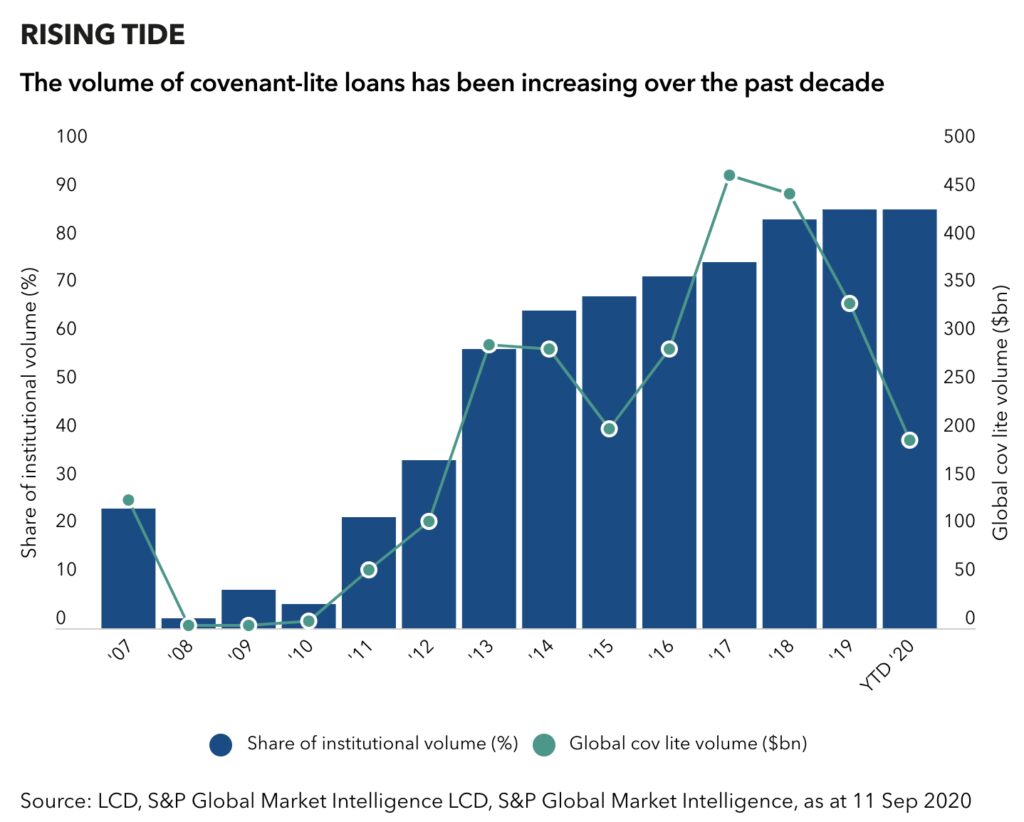

In general, covenants protect the lender from losses and lower the risk of investing in these debt securities. Weaker covenants shift risk from the equity holders to lenders without adequate compensation. Watering down or eliminating covenants has become pervasive in public credit markets.

As of now, nearly 87% of public High Yield Bonds and Leveraged Loans have a covenant-lite structure (meaning a weak covenant package). A Standard & Poor’s Ratings study from 2020 showed that recovery rates after default are 34% higher for debt securities with normal covenant packages.

So how does the private credit market differ from these publicly traded debt markets?

There are far more borrowers than lenders in the private credit markets. Unlike in public debt markets where the borrows have the advantage, in private credit markets, lenders are in control of the terms of the debt. This has led to a market with strong interest rates and favorable covenant packages for lenders.

Presently private credit market lenders are underwriting loans at 8-9% yields. These loans are predominantly 1st Lien Loans, so very senior in priority. The historic annualized loss rate in private credit markets over the last two decades has been just 0.3%. So the default adjusted yield for private credit markets today is close to 8.5%.

Effectively, private credit markets are providing nearly 4x the risk adjusted yield, higher priority in default, and better lender protections through strong covenant packages.

The obvious disadvantage of private credit markets versus public credit markets is liquidity. It is easy to buy or sell the public bonds. Investors have immediate liquidity in High Yield Bonds at the currently quoted price. However, we think that a 75% discount in yield is an enormous cost for liquidity.